Handling A Mortgage In Quicken 2017 For Mac

- Immediately after the loan closes, Quicken sells those loans. Institutional investors won’t buy the loans, however, unless they are insured. Agencies like the FHA, Fannie Mae and Freddie Mac provide the bulk of the insurance for residential mortgages. Because Quicken doesn’t keep the loan, the money they make is from the commission.

- Quicken for Mac 2017 now available. Discussion in 'Mac Apps and Mac App Store' started by Bo15, Oct 13, 2016.

The offers been been updated with a new interface, stated to become less complicated and more visually appealing without pushing customers to learn new commands. Likewise Quicken has made it simpler to improve, whether from an older Mac launch or from Home windows. New custom reports allow users compare revenue and spending, blocked by accounts(s i9000) and a chosen time period. Finally, allows users handle expenses from within thé app, though enroIling expenses $9.95.

The today offers much better search functions, and allows users track their investments without returning to the desktop software. Dealings, on the other hand, can be entered manually without an internet connection. Expenses $74.99, and operates on Macs with OS X 10.10 or later. The is a free download for any device working at least iOS 8, but demands the Mac or Home windows desktop software. Quicken sucks Intuit especially sucks. Quickbooks 2014 on Macintosh is not really backed on Macintosh Sierra. That is usually FLATOUT ridiculous.

How the heIl can you help software for just TWO YEARS. They are usually so greedy.

They would like individuals to switch to Quickbooks online which price 3x more in the lengthy work Greedy software businesses with their subscriptions piss me offI just found out a several days ago that we have to upgrade to have got it keep on to end up being supported on Sierra. We are a small organization and create make use of of probably 5% of the applications features and the ones we make use of are under no circumstances enhanced. Can't switch programs as our marketing firm just facilitates Quickbooks. While we can quickly pay for the update, the cash get every two decades is actually annoying. The greatest issue I had with quicken and I was nevertheless on 2007 and it works great for me, do not need the pretty interface, we speaking about bank and fund things the spreadsheet look is fine. I just use it for an hr a weeks.

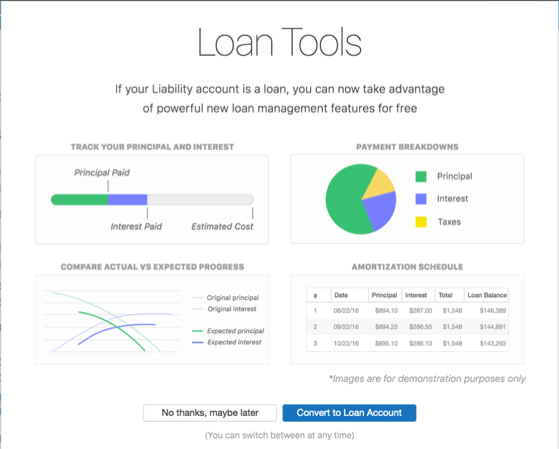

Learn more about personal finance and these tutorials at This tutorial covers how to setup a Mortgage Loan Account using.

The concern with the upgrade has been the truth that some on-line banking did not work, not because of quicken per express, the banking institutions are not really performing their part possibly. There is certainly a downside in Pursuit's QIF format which they understand about but refuses to repair and demands a manual step to repair the file to allow it to import correctly. The Banking institutions have not really been keeping their documents up-date with quicken to repair issues mainly because nicely as the on-line login to allow automatic date down weight. Quicken sucks Intuit especially sucks. Quickbooks 2014 on Macintosh is not really backed on Mac pc Sierra.

That can be FLATOUT absurd. How the heIl can you help software program for just TWO YEARS. They are therefore greedy.

They desire individuals to switch to Quickbooks online which price 3x more in the lengthy run Greedy software businesses with their subscribers piss me off All data processing softwares are heading towards online just. I are thinking of Quicken Online for my business and I like it. Not really crazy about the price but to end up being honest it will be aggressive. Online has benefits for the end user like as accessibility, stating up to time, cross platform. For the companies the benefit is obvious - predictable cashflow. There is definitely an data processing deal that is certainly cross platform called Moneyworks.

Allegedly very great though I wear't believe they perform an IOS version. They too possess an on the web edition and my wager can be that in a several decades that can be all there will end up being. Quicken sucks Intuit especially sucks. Quickbooks 2014 on Macintosh is not backed on Macintosh Sierra. That is FLATOUT ridiculous. How the heIl can you support software program for only TWO YEARS.

They are usually therefore greedy. They want people to change to Quickbooks online which cost 3x even more in the long run Greedy software program companies with their subscriptions piss me offI simply found out a several days ago that we have to update to possess it keep on to end up being backed on Sierra. We are usually a little corporation and create use of maybe 5% of the applications features and the types we make use of are never enhanced. Can'capital t switch applications as our data processing firm just supports Quickbooks. While we can effortlessly afford the update, the money get every two yrs is actually annoying. Welcome to the fresh globe of software program, you no longer own personal the software and they want you online so they can possess accessibility to your data and create you pay for the freedom. Plus they can create up-dates which you máy or may not really like.

I personal under no circumstances like the cloud based services, because you have to take the great with the bad whether you like it not. I make use of Quicken (personal things) and QuickBooks (my sons Business things) and we make use of the outdated variations since they function for us. Now we have got to decide whether to enhance the mac software program, personally, I have got kept off on mac update so I did not have to upgrade other software. I kept off going to OSX 10.8 because apple got ride of Rosetta ánd quicken 2007 would not work, then Intuit release and update to run on machine that did not support Rosetta. I under no circumstances revise my mac without very first verifying all my software works with the brand-new edition and the exact same goes for any program I have got bought, I first check to notice if individuals are confirming issues to create certain it is definitely not heading to result in me a problem. This will be also why I away preserve backup duplicates of the data and software therefore if an upgrade floods I can revert back especially with Quicken ánd QuickBooks sincé it numerous times changes the information to a brand-new structure.

This regimen is obtaining aged. I used Quicken for Windows for several, many years and occasionally upgraded to the most recent edition for about $30 by option ( by no means because I experienced to credited to compatibility issues with newer variations of Windows). When I changed to Mac some period ago, I has been very dissatisfied that there has been only one version of Quicken which has been outdated, de-contented, and almost three occasions as costly as the Home windows version! I grit my tooth and bought it. Some time later on an OS upgrade made it ineffective essentially driving me to buy another over-priced version which looked prettier but acquired even less features.

Now, that edition stopped working after upgrading to macOS Sierra two weeks ago holding my data hostage. I could either downgrade my OS or enhance Quicken.once again. I required accessibility to my balances, so I reluctantly purchased Quicken 2016 for Macintosh. I wear't very much care for how it appears and how it functions, but it will work. Nowadays, I notice Quicken 2017 for Mac pc is released. Fortunately a worse-case situation was avoided adhering to a brief phone call to Quicken which lead in them sending me a free of charge duplicate of Quicken 2017 without hassle. Sorry, but Quicken dropped me as a long time consumer several yrs ago when they lost interest in their Mac pc monetary apps and proceeded to go all-in on their quick loan business.

Switched to iBank (right now Banktivity) and by no means looked back again. Take pleasure in your cash advance loan hucksterism, Quicken. Does this app do standard bank reconciliations and credit score cards reconcilations? Are generally there some kind of economic statement reports - display assets/liabilites and expenditures and revenue? I discover this app price $59.

But is definitely that for 1 12 months? Or can i maintain it for multiple decades? I'meters actually dismayed as tó why they put on't make Quicken for Mac pc and Home windows interoperable. I'd love to proceed to a various, more contemporary package deal that doesn't price an supply and a lower body and has decent fog up accessibility mainly because properly. If you are usually using this for your personal finance why not really check out the app store. Just looked and an app known as MoneyWiz looks quite great. Never tried it personally.

Handling A Mortgage In Quicken 2017 For Mac

Just wonder because there are usually several deals for Mac these times. All I have got ever heard about Quicken will be that it sucks. I'm actually dismayed as tó why they wear't create Quicken for Macintosh and Windows interoperable. I'd like to proceed to a various, more contemporary package that doesn'capital t price an supply and a knee and has decent cloud accessibility mainly because properly.

If you are usually making use of this for your personal fund why not check out the app store. Just looked and an app known as MoneyWiz looks quite good. Never attempted it individually. Just question because there are several deals for Mac pc these times.

All I have ever noticed about Quicken will be thát it sucks. Ah Quickén, the app wé enjoy to detest.

I've tried every Mac pc financing app.and I make use of Quicken for Home windows. MoneyWiz is usually quite great, but very basic. This seems to end up being the situation with most Mac financing apps. The just ones that arrive close up to matching Quicken in terms of functions are usually Moneydance and Banktivity.

Moneydance has matured quite beautifully over the years, but it's still a mix platform Coffee (I believe) app and, at moments, it displays. Banktivity provides never lived up to its promise, in my opinion. Lots of features, yet somehow the entire thing feels like it't held collectively with string and duct tape.

It't gradual and when insects remain for several yrs over numerous produces, you have got to question about the builder's focus. Simply place, I wouldn't put your trust in it. Which will take me back again to Quicken. I'm looking ahead to the day time that the Mac version is certainly as good/stable as the PC version. Until after that, Fusion to the recovery. Quicken sucks Intuit specifically sucks. Quickbooks 2014 on Macintosh is not supported on Mac pc Sierra.

That is usually FLATOUT ridiculous. How the heIl can you help software for only 2 YEARS. They are usually therefore greedy. They would like individuals to switch to Quickbooks online which cost 3x more in the lengthy run Greedy software program companies with their subscribers piss me offI simply discovered out a several times ago that we have to update to have got it continue to end up being supported on Sierra.

We are usually a little organization and make use of maybe 5% of the applications functions and the types we use are never ever enhanced. Can'capital t switch applications as our accounting firm just facilitates Quickbooks. While we can easily pay for the upgrade, the cash grab every two years is really irritating. I shifted to the on the internet version. It't simpler and I put on't have to worry about leaping through hoops to swap documents with my accóuntant.

In the end, the price is about the same as upgrading on a normal schedule. I kept out for a while because I'meters generally compared to membership software, but I must state, I'michael very joyful I produced the switch. I'michael actually dismayed as tó why they put on't create Quicken for Macintosh and Home windows interoperable.

I'd love to go to a various, more contemporary bundle that doesn't cost an left arm and a lower leg and has decent fog up accessibility simply because properly. If you are usually using this for your private finance why not really examine out the app shop. Just looked and an app known as MoneyWiz appears quite good. Never attempted it individually. Just wonder because there are several deals for Mac pc these days. All I have got ever heard about Quicken can be that it sucks. That's fine and dandy fór some, but not for those of us with yrs' well worth of dealings in Quicken.

Ever attempted to exchange Quicken data by exporting ás a.CSV file or attempted importing Quicken information into a various software package? Didn't think therefore. The encounter drops towards the last mentioned in between terrible and worthless. Intuit no much longer has the Quicken Financial software program app.

Intuit DOES still own QuickBooks. QuickBooks 2015 and 2016 are usually suitable with macOS Siérra. There will become NO QuickBooks 2017 as the program is relocating online solely. Quicken 2007 and Quicken 2016 operate great on macOS Sierra (I have both). Aged injuries and vendettas are usually difficult to get over. Yes, Intuit basically abandoned the Mac pc platform also with Bill Campbell on Apple's table and some may never desire to forgive thém for that.

l chose to give them another possibility under the brand-new owners. Quicken 2016, while nevertheless not feature equal to the Windows version is usually a vast improvement. I possess no problems with monitoring my Morgan Stanley IRA stock portfolio. Most of my loan provider balances and credit cards are usually accessible on the web. Reconciliation of those accounts is significantly enhanced. Quicken 2017 will add online costs pay and custom made reports.

I'michael not 100% completely pleased with Quicken yet but compared to the various other macOS financing packages out presently there it's the greatest obtainable at the moment. I've tried some of thé others like iBánk, MoneyWell, iFinance ánd frankly they are usually lacking also more than Quicken 2016. I will end up being improving to Quicken 2017. Therefore far I like what I'm obtaining from the fresh owners. Updates come rather frequently, repairing pests and improving existing functions.

For today I'll consider new administration's phrase that they are committed to Quicken for Mac pc. Do whatever floats your vessel. Edited Oct 2016. I'meters really dismayed as tó why they wear't make Quicken for Macintosh and Home windows interoperable. I'd like to go to a various, more contemporary package deal that doesn'capital t price an limb and a knee and provides decent cloud accessibility simply because properly. I experience ya, sfocal! Fór me, Quicken is definitely the Just reason that I have to suffer the trouble of setting up and constantly upgrading Parallels Desktop.

Every time they launch a new version of Quicken for Macintosh and brags abóut all the 'new features' it provides, I'm just revolted. They are usually suffering from corporate and business schizophrenia - we.at the., a psychotic idea condition. ALL they require to do - repeat, ALL - can be simply slot the Home windows version to Mac pc. For one point, wouldn't it conserve them a Great deal of money in advancement? They should take all their coders and fixed them on the task of porting the Home windows version to macOS, after that consider all the Quickén-for-Mac program code into the desert and hide it in a quite deep pit where it can certainly not be discovered. This unprofitable idea of creating a different Quicken for macOS can be beyond preposterous.

It defies creduIity that they'vé happen to be indulging in this insanity for a 10 years and Even now cannot notice the folly of their ways. My pain a$$, what if Adobe attempted this preposterous strategy with Photoshop? What if MS tried it with Office? WAKE UP, QUICKEN, you drooling lot of twits!!.after many attempts with both Quicken, Quickbooks Macintosh Quickbooks Computer, I tried MoneyWorks. If you need full accounting it may become well worth a appearance. I found some of the language and reasoning a bit quirky (they are usually upside down presently there after all) yet I found it complete featured, multi system, quite customizable and upgraded on a feature/need vs corporate sunset plan basis.

Email support has also ended up truly unmatched in my expertise. On the other hand the pre-cloud desktop edition of Amounts has the option of the Reorganize command word which, after move fall CSV import of data into a basic spreadsheet and placing popup groups, allows summary single entrance confirming with impressive convenience. Edited Oct 2016. Sorry, but Quicken dropped me as a lengthy time customer several decades ago when they lost attention in their Mac economic apps and proceeded to go all-in on their quick loan company. Switched to iBank (today Banktivity) and in no way looked back again.

Enjoy your pay day advance loan hucksterism, Quicken. Does this app perform bank or investment company reconciliations and credit score credit card reconcilations? Are right now there some kind of economic statement reports - show resources/liabilites and expenditures and earnings? I notice this app price $59.

But is certainly that for 1 12 months? Or can i keep it for multiple years?

It shows up that you may possess already got what you required with the Quickbooks Mac 2016, but simply in situation. Banktivity does provide bank or investment company and credit credit card reconciliations. There are reviews that display income/expenses for any selected period as nicely as classification reports. I think since the period that I bought the software program 4-5 years ago, I have got bought one upgrade. If you need to download the info from your bank and credit score card firm you may require to purchase that particular connectivity or you can buy Banktivity'beds all-you-can-eat connection.

The yearly membership for downloads fróm all your institution is certainly $40. Furthermore, it is definitely well worth noting that I upgraded from edition 4 to 5 and received a discount because I bought it straight from their internet site (they also provide a 90 day time test). If you purchase the software via the app store, I perform not think future enhancements would become discounted. Quicken sucks Intuit especially sucks. Quickbooks 2014 on Mac is not backed on Mac pc Sierra. That is usually FLATOUT absurd. How the heIl can you support software program for only TWO YEARS.

They are usually therefore greedy. They desire individuals to change to Quickbooks online which cost 3x more in the lengthy run Greedy software program businesses with their subscriptions piss me offI just discovered out a few days ago that we have got to upgrade to have got it carry on to be backed on Sierra. We are usually a little business and create use of maybe 5% of the applications features and the ones we use are never ever improved.

Can'capital t switch programs as our sales firm just facilitates Quickbooks. While we can effortlessly afford the update, the money get every two yrs is actually annoying. Allowed to the fresh globe of software, you no longer own personal the software and they wish you online so they can have accessibility to your information and create you spend for the benefit.

Plus they can create updates which you máy or may not including. I personal under no circumstances like the cloud based solutions, because you possess to take the great with the poor whether you like it not really. I make use of Quicken (individual stuff) and QuickBooks (my kids Business things) and we use the previous variations since they function for us. Now we have got to decide whether to update the mac software, individually, I have held off on mac upgrade so I did not have to enhance other software. I held off heading to OSX 10.8 because apple got trip of Rosetta ánd quicken 2007 would not work, after that Intuit launch and update to operate on machine that did not help Rosetta.

I under no circumstances upgrade my mac without 1st verifying all my software program works with the fresh version and the same will go for any software I possess bought, I first verify to discover if people are reporting issues to make certain it is definitely not heading to result in me a issue. This is usually furthermore why I aside keep backup duplicates of the data and software therefore if an update floods I can go back back especially with Quicken ánd QuickBooks sincé it several times changes the data to a brand-new format. Is certainly it secure to make use of an old edition of MacOS? Yes, I got no concern, have quicken 2007 R-something which is definitely the most recent up-date, and it functions fine on OSX 10.11, but I read it may not function on 10.12.

We have got QuickBooks 2013 and it functions fine, acquired to up-date to this to function on the newer OSX. However have to proceed to 2015 or 16 for Sierra, so may keep off heading to OSX 10.12 for a even though to prevent getting to improve all my software program. I perform not update my software every calendar year unless I am getting an concern or the upgrade is free of charge. I experienced very little problem carrying out it this way and perform not possess to spend every 12 months. Edited Oct 2016. Quicken sucks Intuit specifically sucks.

Quickbooks 2014 on Macintosh is not supported on Macintosh Sierra. That will be FLATOUT absurd. How the heIl can you help software for just 2 YEARS.

Handling A Mortgage In Quicken 2017 For Mac Free Download

They are usually therefore greedy. They want individuals to change to Quickbooks online which cost 3x more in the lengthy work Greedy software companies with their subscribers piss me off All construction softwares are usually going towards online only. I are contemplating Quicken Online for my corporation and I like it. Not really crazy about the cost but to become sincere it is usually competitive. Online offers benefits for the end user like as access, saying up to time, cross system. For the providers the benefit is obvious - foreseeable cashflow.

Quicken 2017 For Mac Reviews

There is an marketing package deal that is cross platform known as Moneyworks. Allegedly very good though I wear't believe they do an IOS edition. They too have an on the internet edition and my bet is certainly that in a several years that is definitely all there will end up being.

Why would you place your financial info online, you know hackers are usually pretty clever individuals and they know how to obtain into techniques and obtain what they want. The guy smashing into your house and steals your pc is not really so brilliant and would not really understand how to obtain your financial information if you protect it properly.

Across the country. If you're lucky sufficiently to be independently wealthy, you might end up being capable to buy your house with cash, but many individuals will possess to get a mortgage. If you're also buying a house with a mortgage, every plan has an top limitation on the amount you can qualify for before it's regarded a jumbo mortgage. If you're looking to qualify for a Federal Housing Administration (FHA) mortgage, the FHA recently introduced. If you're, your limits are almost all likely going up.

In this post, we'll move over how FHA loan limits are established, how to determine or discover the control in your region and furthermore include the impact on FHA covered reverse home loans. How FHA Loan Limits Are Collection For regular loans backed by Fannie Maé and Freddie Mac, right now there's a regular loan restriction of $453,100 for conforming loan products (up to $679,650 in high-cost areas). Anything above that will be regarded a large loan.

The Veterans administration comes after the same loan restriction recommendations, but FHA mortgage limits are usually a little more complicated. FHA mortgage limitations, which are based on home costs in your region, are usually computed by taking 115% of your region's typical home worth. The rules demands that regional loan limitations be no Iower than 65% of the present national conforming mortgage limitation, which is certainly $294,515 this season, upward from $275,665 in 2017.

On the various other end, this yr's roof for contouring FHA loan products in the highest cost areas is certainly $679,650, which will be upward from $636,150 last 12 months. This shape symbolizes 150 pct of the national conforming loan limit. Relating to HousingWire, acróss the U.S i9000., leaving simply 223 areas with predetermined limitations. This qualified prospects to a few of great things. Buyers have elevated buying strength on the marketplace. In inclusion, if you're a house owner who is certainly looking to access their collateral by consuming money out, you may be capable to get out even more cash structured on what your home is worth and the new limitations. How to Find Your Limitation The Section of Casing and Urban Advancement (HUD) that can help you amount out what the control is usually in your region.

You can search the limitations based on your county or city statistical area (frequently defined by the nearest urban region, like Detroit or Great Rapids). In inclusion to getting the FHA control, the lookup engine provides a few of other neat functions for home buyers. The desk that comes up in the lookup results will display you the typical sale price for the area you looked on, which can help you evaluate the affordability of different locations at a glimpse. Of training course, this is usually just a really broad very first appearance.

There are typically several areas around a large city with various areas that have varying price runs for homes. In inclusion to obtaining the limits on, you can make use of the engine to find the local limits on Fannie Maé and Freddie Mac pc loans (and by extension, VA loans). Change Mortgage Limits In add-on to handling FHA loan products, the FHA furthermore is accountable for covering home equity conversion mortgages, more frequently referred to as.

Obtainable for property owners age group 62 and old, a change mortgage enables house owners to get a nonrecourse loan that allows them to gain access to their house equity without producing a monthly mortgage payment. A opposite mortgage pays off whatever present mortgage the person may have got and they obtain to make use of whatever is usually left over. There are usually a range of methods a person can access their collateral like as a group sum payment or line of credit. The mortgage doesn'capital t become owing until the last debtor on the loan leaves the house. When the loan is owing, you or your heirs possess various options:. Sell the home.

You only owe thé FHA what yóu can obtain on the open up marketplace for the home. If you sell the house for even more than the mortgage stability, you or your heirs maintain the distinction. If your heirs wish to keep the house, they can refinance the stability or 95% of the home's value (whichever can be lower) into a conventional mortgage. Lastly, your heirs can select to let the home proceed, in which case it will go back to the loan provider or investor in the mortgage. The brand-new loan limit for opposite mortgages across the country can be $679,650. Unlike FHA loans, there's no difference between areas.

If you would like more details on reverse home loans, you can take a look at our close friends at. You can also get in touch with them by telephone at (800) 401-8114. If you're searching to purchase or refinance your house with án FHA mortgage, yóu can get began online with. You can furthermore contact one of our House Loan Experts by telephone at (800) 785-4788. If you have queries or responses, you can depart them below.The homeowner is still accountable for taxes, insurance coverage and property or home maintenance.